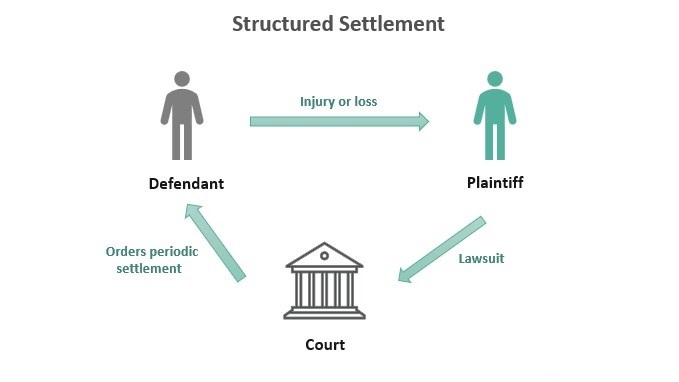

Most structured settlements begin with a civil lawsuit. When the plaintiff wins and is awarded financial compensation, the defendant usually cannot pay the full amount out of pocket. Instead, they buy an annuity with an insurance company that spreads the payments over time. This is the money you receive, often as fixed payments, when you win a structured settlement.

Types of structured settlement payments

The judge presiding over your case will usually decide how the payment is structured based on what kind of financial needs you are likely to have in the coming years.

However, there is a lot of flexibility to tailor payments to your individual needs. With the help of your attorney, you can negotiate payment frequency, adjust the value of each payment, and decide whether to start receiving funds immediately or delay them.

In addition to a fixed payment schedule, here are some other structures you can consider:

Lump sum with smaller ongoing payments: In some cases, you may receive one large payment at the beginning of your structured settlement, followed by smaller ongoing payments over time. This is common if your case involves an injury or other problem that requires medical attention. The idea is to give you more than that to cover health care costs.

Scale-up payments: Another payment structure is to receive small payments first, which increase over time. This arrangement may be used if damages, such as an injury, are expected to worsen over time.

Scaled-down payments: If you expect to recover or don’t need more funds in the future, you can get a structured settlement with payments that decrease over time.

Additional payments: Another option is to receive fixed payments from time to time, in addition to additional payments that may be required for extraordinary expenses. For example, a minor who receives a structured settlement may receive scheduled payments to pay for college tuition when the time comes.

Delayed payments: In some cases, you may prefer to delay payments until you reach retirement age. If you don’t have specific, additional financial needs at the time of your lawsuit, this may be an option to help you retire comfortably.

What Is a Structured Settlement? | Structural settlements are defined.

A structured settlement is a type of court settlement that is paid annually rather than as a one-time, lump-sum payment. An orderly settlement generally provides tax benefits to the receiving party while also providing some savings to the paying party. These settlements offer financial security, stability and tax benefits. While structured settlements are facilitated by annuities, they are tailored specifically to meet the needs of the recipient.

Definition of an organized settlement next to a graphic of a money bag and gavel

SPREAD OUT

Structured settlements are relatively simple. Many civil lawsuits result in one person or company paying another to right a wrong. Those found at fault may agree to settle on their own, or be forced to pay if they lose a court case.

Structured settlements are usually voluntary arrangements between the defendant and the injured party—both parties usually have a say in whether to set up a structured settlement or opt for a lump sum payment.

If the amount of money is small enough, the wronged party may choose to receive a lump sum. However, for larger amounts, a structures settlement annuity is usually arranged. Various factors often influence this decision, including the financial needs and preferences of the recipient, future financial planning and tax considerations, and the overall negotiation process between the parties involved.

When an orderly settlement is orders, the party at fault puts the money toward an annuity — a financial product issued by an insurance company that guarantees regular payments over time.

The agreement also details the series of payments that the awarded party will receive as compensation for the damages caused to them. Spreading the money over a longer period provides a better guarantee of financial security because the recipient cannot quickly spend the series of payments.

How do structured settlements work?

Structural settlements are the result of legal settlements that are ultimately pays by insurance companies. But there are four parties involves in structured settlement work.

PARTIES INVOLVED IN A STRUCTURED SETTLEMENT:

Claimant

The injured party. A claimant files a lawsuit against the party they claim has been injured.

Defendant

The party against whom the claimant sues. If the defendant loses the case in court—or settles before it goes to court—they can set up a structured settlement to pay the settlement.

Assignment Company

The defendant—or their insurance company—enters into a qualified assignment to transfer their obligations to make periodic settlement payments to the claimant. The liability is transfers to an assignment company that accepts the liability.

Insurance company

Assignment companies usually work with life insurance companies. The assignment company purchases a structured settlement annuity from the life insurance company and issues payments to the claimant for the duration of the annual contract.